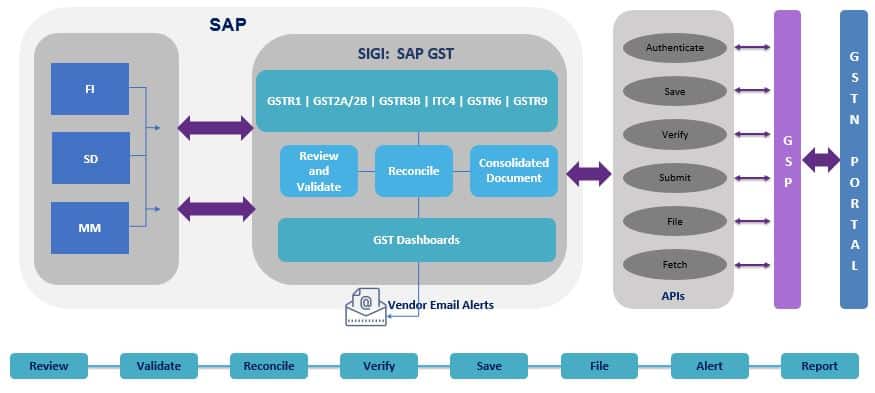

Sigitek SAP GST Return Filing is the ultimate solution to manage all aspects of Goods & Services Tax Management. The solution is developed on SAP Technology & doesn’t need any ASP Service Provider as it has ability to integrate directly with GSTN Portal.

It comes with 2 Versions such as Manual & Automation. Now you can file GSTR1, GSTR2A/2B, GSTR3B, ITC4, GSTR6, GSTR9 directly from SAP.

SAP GSTR1

SIGI SAP GST is the ultimate solution to manage all aspects of Goods & Services Tax Management. The solution is developed on SAP. One Click e-filing of data from SAP to GSTN Portal.

Our Solution comes with 2 Flavour – Manual Filing & Automated Filing of GSTR1

SAP GSTR2A/2B

Do Not Loose your input-credit just because of Accounting Errors

Compare GSTR2A OR 2B Data with Purchase Register and findout the differences in minutes in SAP.

- Easily get the Invoice Numbers which are available in the GSTR2A/2B but missing in your SAP

- Find invoices which are missing in the GSTR2A /2B

- Auto Vendor Alert and many more features.

The Solution comes with 2 Versions such as Manual & Automation.

SAP GSTR3B

Auto Preparation of GSTR3B in SAP. It also helps you to reconcile the data with 2A/2B & GSTR1 in SAP. Sametime, Data from GSTN Portal of 3B in Auto Populated in SAP to reconcile and find the difference.

With a Single Click, you can re-upload the SAP Data in GSTN Portal, if any discrepancy.

The Solution comes with 2 Version such as Manual & Automation

Our SAP GST Solution in SAP is a comprehensive solution developed on SAP Technology. It helps you to eliminate manual e-filing of GST or transferring data to any 3rd pary software or ASP Provider.

Beyond GSTR1, 2A/2B, GSTR3B, we do have also Out of The Box solution for ITC4, GSTR6, GSTR9 developed on SAP Technology

Our Solution doesn’t need any addon SAP License from SAP.